Saturday, April 17, 2010

New Oracle Financials Blog

If you have any other blogs of interest or tweeters, please share them with all the readers in the comments below.

Sunday, November 16, 2008

FSAH and AGIS Intercompany Implementation thoughts

As Intercompany transactions are very likely to cross systems they are a good candidate for integration in a 'Hub' of some sort.

In R12 the Financials Services Accounting Hub (FSAH) allows integration of third party systems to Oracle and is incredibly powerful and flexible.

Let's use a simple example:

Company A and B both use two different Ledgers. A Sales Invoice is issued by Company A (to Company B) for $5,000

The accounting needs to be created as below, they need to be booked with the same accounting date in the same period.

In Company A

Debit Intercompany AR $5,000

Credit Intercompany sales $5,000

In Company B

Debit Expense or inventory (per content), $5,000

Credit Intercompany AP, $5,000

So there's a number of options that come to mind (in no particular order).

1) Using Oracle Accounting Hub you can account for transactions form third party systems, it uses the Subledger accounting engine to process accounting events defined for the third party system. If your invoice systems are third party applications, you could create 2 events (one for each company/ledger/party to the transaction) for the sales invoice and get the full accounting out of the single system integration.

2) Enter these transactions in AGIS, the specific accounting will be entered/generated and approvals from company A and B obtained before AGIS either books it direct to GL or generates the Invoice for company A and B if required.

3) It may not be ideal to force users to navigate to a different screen (or change some import process, EDI, XML feed etc) to issue Intercompany invoices from other invoices as in 2) above. So continue to enter in your regular sales invoice system but run a process which detects an invoice is Intercompany and cancels it, then generates a transaction for it in AGIS (via the Open Interfaces) or FSAH.

I don't think any one of these is right for all situations, detailed analysis of the particular implementation environment and requirements needs to be done to figure out the best approach. If you have any thoughts, better suggestions or experience then please share them in the comments.

Thursday, September 18, 2008

Financials Sessions at Oracle Open World 2008

My session is listed there, I look forward to seeing some of your there.

Thursday 25th, 3:00 p.m.

Moscone West 2006

Are Intercompany Processing and Reconciliation Currently Pain Points for Your Enterprise?

David Haimes, Oracle; Helle Hennings, Oracle

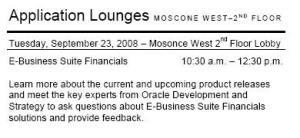

I blogged last year about the meet the Experts Lounge, well this year it has been renamed to Applications Lounge. I haven't been asked to attend this year, so if you want to ask me any questions or provide feedback you'll have to come to the session above, find me at the DEMOgrounds, the Blogger Meetup or follow me in twitter, or use this blog all year round - remember customer interaction is not just for Oracle Open World, it's for life.

I blogged last year about the meet the Experts Lounge, well this year it has been renamed to Applications Lounge. I haven't been asked to attend this year, so if you want to ask me any questions or provide feedback you'll have to come to the session above, find me at the DEMOgrounds, the Blogger Meetup or follow me in twitter, or use this blog all year round - remember customer interaction is not just for Oracle Open World, it's for life.

Friday, August 15, 2008

Fixed Assests Intercompany in R12

[/caption]

[/caption]Something I often forget to mention is the enhancement of Intercompany functionality in Fixed Assets (FA) that has been provided in R12. So here is my attempt to explain it, based on an old email discussion with the FA team, I wouldn't describe myslef as an FA expert, but if there are any comments or questions I might be able to find an FA expert to get an answer. :)

In 11i FA stores reference accounts in two setup entities; Book Controls and Categories. The intercompany Payables and Receivables accounts were stored directly on the book, only the natural accounts segment were stored for these two accounts. The Account Generator definition would combine the natural account with other sources to get a full account combination. Out of the box, those sources were a default ccid which is also on the book and a ccid from the asset assignment. So the balancing segment is derived from the asset assignment, the natural account from the values on the book, and other segments from the default account.

The intercompany would kick in for two transaction types "Transfer" and "Unit Adjustment". However, other transactions could result in intercompany impacts, but they would not be generated in FA so GL would do the balancing when the accounting was posted there.

So in R12 FA uses the AGIS Intercompany balancing feature, which is

Monday, May 12, 2008

Financial Services Accounting Hub (FSAH)

Financial Services Accounting Hub or FSAH (pronounced F-saa apparently) is a great product and is not only for Financial Services companies either, I understand we'll sell it to anyone.

Financial Services Accounting Hub or FSAH (pronounced F-saa apparently) is a great product and is not only for Financial Services companies either, I understand we'll sell it to anyone.From a (very) high level perspective it allows you to use Oracle SLA and GL to perform the accounting for third party applications. Companies the Financial services industry tend to build a lot of highly complex applications (e.g. loan systems, trading systems) in house, but they want the final accounting of transactions form these disparate system to end up in the same place and it will be nice if they can re-use the same accounting rules too.

Monday, March 24, 2008

AGIS Out of the Box

When I was about 10 years old I got a new electric train set for Christmas, but before I got to play with it I had to pinch a plug from one of my siblings toys and fit the only available (and dangerously mismatched) fuse in it. Then I had to read a complicated set of instructions to assemble a delicate set of parts and it was a minor miracle that I had it working before the New Year.

Now when I buy something new, the first thing I do is open the box, turn it on and press buttons to work out how to use it, if I get stuck I maybe look to see if they have a quick start guide. Consumer goods manufacturers make things very intuitive and ready to work right out of the box these days and we have grown to expect that. Remember that iMac add? step 1: plug into power, step 2: plug into a phone line, step 3: - there is no step 3! Wow can I have an ERP system like that please?

When designing AGIS for R12 we tried to minimize the time it would take to get started entering transactions in an initiative we internally called 'AGIS out of the Box'. I have to give credit to this idea to my former bosses Joe and Terrance for initiating this, but the whole team stopped, sat down and thought about what we could do to allow users to open the box and start using AGIS right away.

We came up with a few ideas

1) No profile options

Monday, January 28, 2008

Defining Intracompany Balancing Rules

In order to take advantage of the automatic Intercompany balancing during GL posting and SLA Accounting you first need to define the accounts you want us to use.

Intercompany and Intracompany Accounts in R12 are defined in two different Set Up Pages, the Intracompany Balancing Rules are what we had in 11i for Intercompany Accounts (confusing I know) - this is where you will find the rules you had in 11i of you are upgrading from 11i. If you don't want to take advantage of the Legal Entity Configurator product and define Legal Entities and map them to your accounting structure, you can still go ahead and use the intracompany rules. If you start to map your Legal Entities to Ledgers and/or Balancing Segment Values (BSV) then you will want to be sure you complete the job, so there is no ambiguity in your setup. Consider the example below

Friday, November 30, 2007

Is Oracle Cool Again?

I joined Oracle UK in 1997 when Oracle 8 was just out to a lot of buzz. I had written a College paper on Designer 2000, which in 1995 sounded futuristic; automatic code generation and reverse engineering of code was a hot topic around then. All in all it felt pretty good to be joining Oracle and many of my college friends were impressed, especially as I was joining product development. Things went well, I learned a lot, 8i came out, I was involved in building 11i which was on the latest tools and then I moved out to the US in 2000 at the height of the dot com boom.

I joined Oracle UK in 1997 when Oracle 8 was just out to a lot of buzz. I had written a College paper on Designer 2000, which in 1995 sounded futuristic; automatic code generation and reverse engineering of code was a hot topic around then. All in all it felt pretty good to be joining Oracle and many of my college friends were impressed, especially as I was joining product development. Things went well, I learned a lot, 8i came out, I was involved in building 11i which was on the latest tools and then I moved out to the US in 2000 at the height of the dot com boom.

Thursday, November 22, 2007

New Intercompany features in R12

- Creation of Documentation (ie. Payables and Receivables Invoices) for AGIS transactions

Tuesday, November 20, 2007

How do I define my Legal Entities?

So let's look at the relationships LE have to other E-Business suite objects.